What Qualifies For Residential Energy Credit 2021 . (updated april 27, 2021) a. you might be eligible for this tax credit if you meet all of the following criteria: Who is eligible for tax credits? details for claiming the residential clean energy credit: If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or. — get details on the energy efficient home improvement credit. Homeowners, including renters for certain expenditures, who purchase. — residential clean energy credit. If you invest in renewable energy for your home such as solar, wind,. The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to reduce your taxes. — key takeaways. Who qualifies to claim a residential energy property credit?

from www.templateroller.com

(updated april 27, 2021) a. The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to reduce your taxes. — get details on the energy efficient home improvement credit. If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or. details for claiming the residential clean energy credit: you might be eligible for this tax credit if you meet all of the following criteria: Who qualifies to claim a residential energy property credit? — key takeaways. Who is eligible for tax credits? If you invest in renewable energy for your home such as solar, wind,.

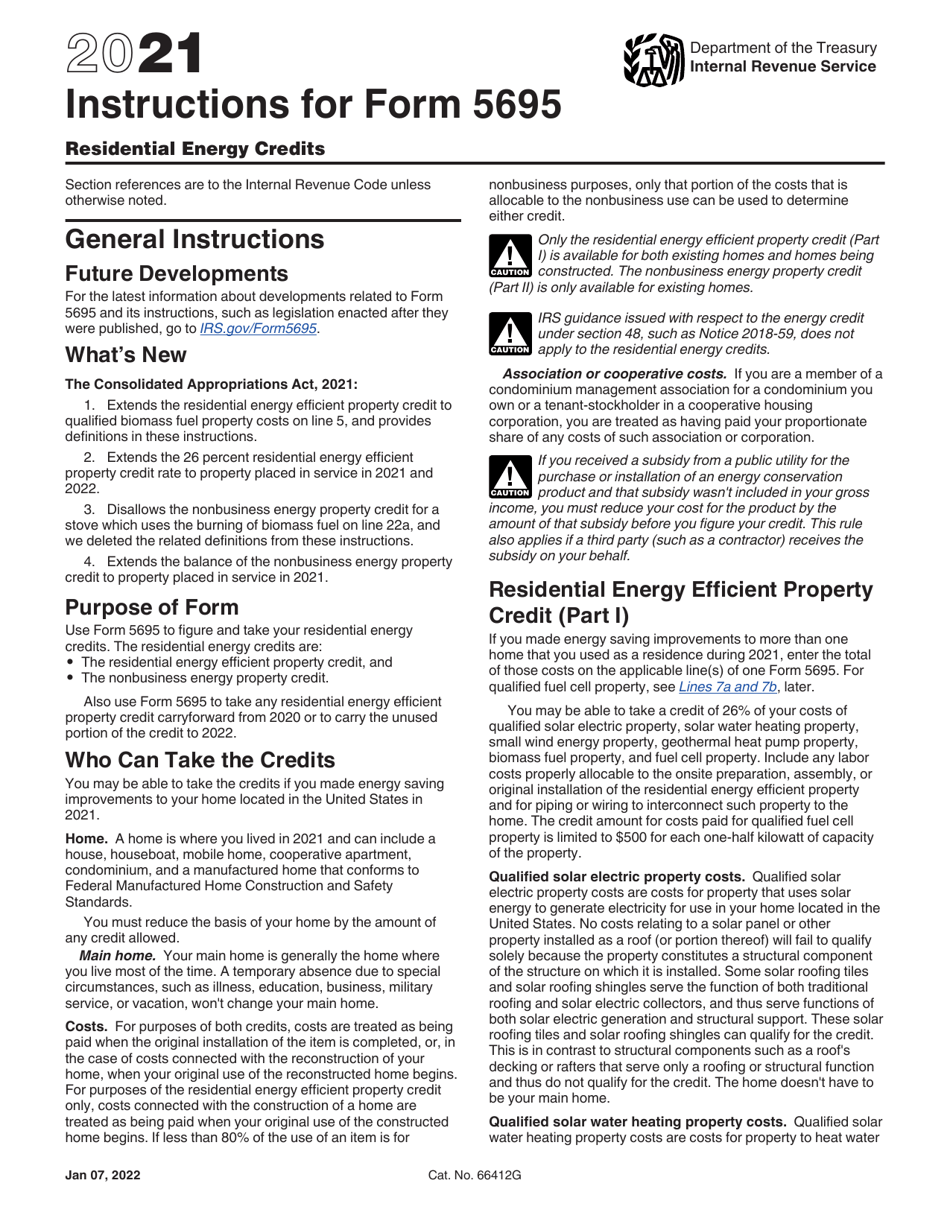

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

What Qualifies For Residential Energy Credit 2021 Who is eligible for tax credits? details for claiming the residential clean energy credit: you might be eligible for this tax credit if you meet all of the following criteria: — residential clean energy credit. — get details on the energy efficient home improvement credit. If you invest in renewable energy for your home such as solar, wind,. Who is eligible for tax credits? Homeowners, including renters for certain expenditures, who purchase. (updated april 27, 2021) a. If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or. — key takeaways. Who qualifies to claim a residential energy property credit? The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to reduce your taxes.

From www.vrogue.co

Form 5695 Residential Energy Credits Db Excel Com vrogue.co What Qualifies For Residential Energy Credit 2021 Homeowners, including renters for certain expenditures, who purchase. — get details on the energy efficient home improvement credit. — residential clean energy credit. you might be eligible for this tax credit if you meet all of the following criteria: Who qualifies to claim a residential energy property credit? (updated april 27, 2021) a. Who is eligible for. What Qualifies For Residential Energy Credit 2021.

From eyeonhousing.org

Use of Residential Energy Tax Credits Increases What Qualifies For Residential Energy Credit 2021 details for claiming the residential clean energy credit: If you invest in renewable energy for your home such as solar, wind,. you might be eligible for this tax credit if you meet all of the following criteria: The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to. What Qualifies For Residential Energy Credit 2021.

From fabalabse.com

What is energy property credit? Leia aqui What qualifies for energy What Qualifies For Residential Energy Credit 2021 The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to reduce your taxes. you might be eligible for this tax credit if you meet all of the following criteria: — key takeaways. If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or.. What Qualifies For Residential Energy Credit 2021.

From myans.bhantedhammika.net

Form 5695 Residential Energy Credits What Qualifies For Residential Energy Credit 2021 you might be eligible for this tax credit if you meet all of the following criteria: details for claiming the residential clean energy credit: — get details on the energy efficient home improvement credit. Who qualifies to claim a residential energy property credit? — key takeaways. — residential clean energy credit. Who is eligible for. What Qualifies For Residential Energy Credit 2021.

From energydiagnosticsinc.com

45L Tax Credit Energy Diagnostics What Qualifies For Residential Energy Credit 2021 — residential clean energy credit. — key takeaways. If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or. Homeowners, including renters for certain expenditures, who purchase. Who qualifies to claim a residential energy property credit? Who is eligible for tax credits? If you invest in renewable energy for your home such as solar,. What Qualifies For Residential Energy Credit 2021.

From solgenpower.com

Guide to Green Energy Tax Credits and Incentives for Homeowners What Qualifies For Residential Energy Credit 2021 details for claiming the residential clean energy credit: you might be eligible for this tax credit if you meet all of the following criteria: — key takeaways. If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or. Who is eligible for tax credits? If you invest in renewable energy for your home. What Qualifies For Residential Energy Credit 2021.

From www.usnatgascorp.com

What Qualifies for Energy Tax Credit in 2023? What Qualifies For Residential Energy Credit 2021 you might be eligible for this tax credit if you meet all of the following criteria: details for claiming the residential clean energy credit: If you invest in renewable energy for your home such as solar, wind,. (updated april 27, 2021) a. Who is eligible for tax credits? The energy efficient home improvement credit provides tax credits for. What Qualifies For Residential Energy Credit 2021.

From www.youtube.com

How To Fill Our Form 5695 For Residential Energy Credits Meru What Qualifies For Residential Energy Credit 2021 — residential clean energy credit. (updated april 27, 2021) a. you might be eligible for this tax credit if you meet all of the following criteria: — get details on the energy efficient home improvement credit. The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to. What Qualifies For Residential Energy Credit 2021.

From aliterarycocktail.com

What You Need to Know About Residential Energy Credits for Energy What Qualifies For Residential Energy Credit 2021 details for claiming the residential clean energy credit: The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to reduce your taxes. (updated april 27, 2021) a. you might be eligible for this tax credit if you meet all of the following criteria: Who qualifies to claim a. What Qualifies For Residential Energy Credit 2021.

From blog.turbotax.intuit.com

Residential Energy Efficient Property Tax Credit Helps You Go Green and What Qualifies For Residential Energy Credit 2021 — get details on the energy efficient home improvement credit. (updated april 27, 2021) a. — residential clean energy credit. Who qualifies to claim a residential energy property credit? If you invest in renewable energy for your home such as solar, wind,. If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or. Homeowners,. What Qualifies For Residential Energy Credit 2021.

From xscapers.com

Residential Solar Energy Credit What You Need to Know for 2021 Taxes What Qualifies For Residential Energy Credit 2021 Who is eligible for tax credits? Homeowners, including renters for certain expenditures, who purchase. — residential clean energy credit. If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or. Who qualifies to claim a residential energy property credit? you might be eligible for this tax credit if you meet all of the following. What Qualifies For Residential Energy Credit 2021.

From blog.turbotax.intuit.com

Residential Clean Energy Credit What It Is & What Qualifies Intuit What Qualifies For Residential Energy Credit 2021 (updated april 27, 2021) a. Who is eligible for tax credits? details for claiming the residential clean energy credit: — residential clean energy credit. If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or. Homeowners, including renters for certain expenditures, who purchase. — get details on the energy efficient home improvement credit.. What Qualifies For Residential Energy Credit 2021.

From blog.turbotax.intuit.com

Residential Clean Energy Credit What It Is & What Qualifies Intuit What Qualifies For Residential Energy Credit 2021 (updated april 27, 2021) a. Who is eligible for tax credits? If you invest in renewable energy for your home such as solar, wind,. — get details on the energy efficient home improvement credit. details for claiming the residential clean energy credit: Who qualifies to claim a residential energy property credit? — key takeaways. — residential. What Qualifies For Residential Energy Credit 2021.

From accountants.sva.com

IRS Updates on Residential Energy Credits Key Insights What Qualifies For Residential Energy Credit 2021 Homeowners, including renters for certain expenditures, who purchase. — residential clean energy credit. The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to reduce your taxes. you might be eligible for this tax credit if you meet all of the following criteria: If you invest in renewable. What Qualifies For Residential Energy Credit 2021.

From theadvisermagazine.com

Residential Clean Energy Credit What It Is & What Qualifies What Qualifies For Residential Energy Credit 2021 Homeowners, including renters for certain expenditures, who purchase. — residential clean energy credit. — key takeaways. details for claiming the residential clean energy credit: you might be eligible for this tax credit if you meet all of the following criteria: If you invest in renewable energy for your home (solar, wind, geothermal, fuel cells or. If. What Qualifies For Residential Energy Credit 2021.

From fabalabse.com

What qualifies for energy tax credit in 2023? Leia aqui What is the What Qualifies For Residential Energy Credit 2021 details for claiming the residential clean energy credit: Homeowners, including renters for certain expenditures, who purchase. (updated april 27, 2021) a. — get details on the energy efficient home improvement credit. The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to reduce your taxes. — key. What Qualifies For Residential Energy Credit 2021.

From fabalabse.com

What is the ratio of residential energy tax credit to taxable What Qualifies For Residential Energy Credit 2021 — get details on the energy efficient home improvement credit. Homeowners, including renters for certain expenditures, who purchase. you might be eligible for this tax credit if you meet all of the following criteria: — residential clean energy credit. — key takeaways. If you invest in renewable energy for your home such as solar, wind,. The. What Qualifies For Residential Energy Credit 2021.

From eyeonhousing.org

New Residential Energy Tax Credit Estimates Eye On Housing What Qualifies For Residential Energy Credit 2021 — get details on the energy efficient home improvement credit. Who is eligible for tax credits? (updated april 27, 2021) a. The energy efficient home improvement credit provides tax credits for the purchase of qualifying equipment, home improvements, and energy audits to reduce your taxes. If you invest in renewable energy for your home such as solar, wind,. Who. What Qualifies For Residential Energy Credit 2021.